Explore Distributed Generation

Distributed Generation (DG) is a system located on-site, either on a roof or mounted on the ground, that generates electricity that is used directly on site. Distributed Generation projects are sometimes described as sitting “behind” a customer’s electrical meter.

Customers may choose on-site Distributed Generation solar for many reasons, including reduced energy costs, general environmental benefits of solar, and more. Systems can range from small arrays to serve the electric load of a home or business or large arrays to serve the electric load of an industrial site, factory, or other large electricity user.

Solar panels generate electricity from sunlight.

An inverter turns the electricity into alternating current, and can be stored with a battery and even returned to the grid.

Electricity generated by the solar project powers your home!

Hover over the dots for more detail

How Illinois Shines Projects Produce REC Incentives, and Other, Separate Consumer Rebate and Credit Opportunities

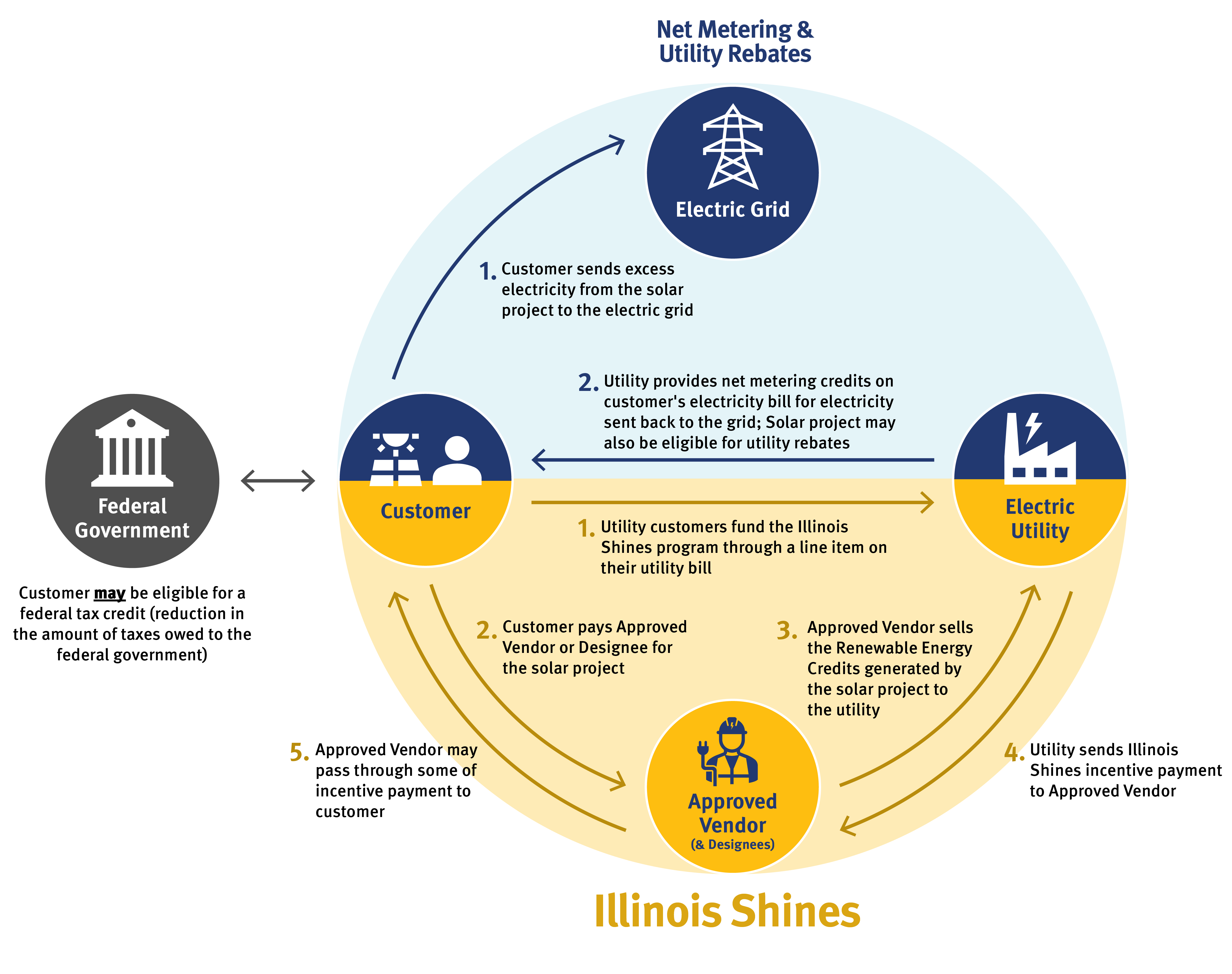

This graphic illustrates several important processes. The yellow section demonstrates how Illinois Shines works, from Program funding, to project installation and REC generation, to invoicing utilities, and distribution of incentives. The blue section demonstrates customer opportunities for net metering and utility rebates, outside of the Illinois Shines program, and the gray section describes additional federal tax credit opportunities.

Goals & Considerations

There are many options for building and financing a DG system. There are important factors to consider as you are deciding what may be right for you.

Solar can help you lower your overall electricity bill. When your solar system is sized right for your typical electric usage, a customer will likely see savings on their electricity bill.

Consider how long you intend to be in or own your home, school, or business, when calculating the economic opportunity and commitment of Distributed Generation and the financing options for a Distributed Generation project. The terms of your contract with the Approved Vendor, REC contract, and loan commitments are important to consider.

Whether your DG project is sited on a rooftop or ground mounted may be dictated by your preferences, roof and terrain considerations, permitting, aesthetics and costs.

Rooftop systems can be more challenging to install and repair, may affect your roof warranty, and may not be viable depending on your roof condition or materials, timeline for roof replacement, and the angle and direction your roof faces or the shading it experiences. But rooftop panels may actually protect your roof by absorbing the rays of the sun, save space, and can typically cost less to install as they utilize existing building infrastructure.

Ground mounted systems can be more expensive to install, can take up more space, and create property care challenges. But ground mounted systems may be more effective at capturing sunlight based on siting and angling, can be easier to expand and to maintain, and generally offer better performance due to better airflow.

Finding a Vendor You're Comfortable With

Installing solar panels is a commitment that should be carefully considered. You should feel comfortable and confident with your decision, including the solar provider. Illinois Shines vets solar vendors through a careful enrollment process, and requires vendors to provide Disclosure Forms to customers with critical project and cost information prior to contracting. The Program provides resources and required information to participating vendors and designees to help ensure they comply with Program requirements, and provides consumer protections support to customers who believe a vendor may have violated program rules. Even with these safeguards, consumers should be careful when choosing which vendor to work with. Here are some helpful tips:

As with any large financial commitment, customers should speak with multiple providers to understand all the options and approaches, including considering projects managed by Equity Eligible Contractors. It’s always wise to get multiple bids for a project. Illinois Shines requires that customers receive a Disclosure Form prior to contracting, which can give you an “apples-to-apples” comparison that makes it easier to analyze differently structured bids, costs and projections, and different financing options.

Ask for customer references from solar vendors that you are considering. You can ask these customers about their experience with the vendor, such as whether the customer was satisfied with the work, whether the vendor was responsive to questions, etc. You can also review the Program’s Consumer Complaints Report to see any complaints against a specific vendor, and the Program Violations Report to see if a vendor has been suspended or has a recent warning.

Review the Guide to Going Solar for additional information, including the Program requirements of participating vendors and designees must adhere to regarding sales and marketing activities. Consumers are invited to engage the Consumer Protection team if they feel a participating entity has violated these requirements.

What Should You Look For In a Bid?

For every Illinois Shines Distributed Generation project, vendors are required to present a Disclosure Form to customers, which includes overall contract costs, deposits and payments that are due (installation and maintenance), how much of the Illinois Shines incentive payment the vendor will be passing on to the consumer, design specifications, estimated installation start and completion dates for project installation, project efficiency, terms for project operations, maintenance, warranties and guarantees, property transfer requirements, estimates of the value of electricity and savings your system will produce, and additional information. Customers are encouraged to use the Deep Dive into your Disclosure Form tool to better understand the details of your Disclosure Form. This tool walks you through Disclosure Forms, which vary by project and financing type, with a section-by-section preview of the information you’ll encounter and what it means.

Depending on the type of contract you’re considering and the vendors you are speaking with, the calculations about overall costs and net savings may vary. The Disclosure Form provides a standardized format that makes it easier for you to make a comparison across vendors and differently structured and varying financing types.

Participating in Illinois Shines doesn’t prevent you from pursuing other solar financial incentives and tax credits that may be available.

What Questions Should You Ask?

With so much to consider, it’s important to ask solar vendors a variety of questions. Click a category to see question(s) to consider asking. You can also download a PDF of these questions here.

Your Offer

Will the Approved Vendor directly or indirectly pass through value from the Illinois Shines incentive to me, such as through reduced costs?

(Note: Illinois Shines uses an “Approved Vendor” model, where Approved Vendors contract with utilities and receive REC incentive payments, not customers. Approved Vendors may pass incentives on to customers in the form of reduced equipment, installation, lease or power purchase costs for distributed generation projects, or reduced community solar subscription costs).

What is the total project budget, including all costs, incentives, contractual commitments, and payment terms?

About Your Vendor

What similar projects has your company installed for customers like me?

Your System

What solar panels and inverters does your company use?

Who will secure the necessary permits and submit the net-metering and Program applications?

Who performs the installation? How long will it take? What parts of my home will installers need access to?

Will the system use a battery storage component? If so, are there added costs?

Post-Installation

What performance warranties and system insurance are included?

What support, maintenance, and repair services are offered by the provider? Is removal or reinstallation provided if the roof needs replacement? Is your system under warranty?

What happens to the system if you move?

Can the company sell your contract? What if the solar provider goes out of business?

Financing Options

There are multiple ways to build and finance Distributed Generation solar projects, including three primary financial and contract structures. The different models affect the system’s ownership, maintenance, costs and more.

System Purchase

Customer buys the system outright, either via upfront payment or through a loan. Ownership includes all financial benefits that accompany a system including net metering credits—which are financial credits that can be earned when a system generates more electricity than it uses—as well as all responsibilities, such as ongoing maintenance. Loans to finance an installation may be traditional home equity loans or can be specific solar loans issued by banks or other institutions, or via some solar installers.

Lease

Much like leasing a car, the customer makes monthly payments for the use of the solar system, while the ownership lies with the Approved Vendor or installer. There may be no upfront cost, allowing customers to save immediately if the value of the electricity is more than the cost of the lease. Lease payments may change over time, so the customer should review the agreement closely.

Power Purchase Agreement (PPA)

Customer pays monthly for the electricity generated by the system using an agreed upon price-per-kilowatt hour. A PPA may not have large upfront costs like an outright purchase and may yield immediate savings if the price the customer pays for the electricity from the panels is less than they would have paid to buy the electricity from the utility. The amount paid per kilowatt hour may change over time, so the customer should review the agreement closely.

| System Purchase (including with loan) | Power Purchase Agreement | Lease | |

|---|---|---|---|

| System purchaser and owner | Homeowner/Business owner | Third party | Third party |

| Operation and maintenance responsibility | Homeowners/Business owner, unless otherwise noted in agreement | Third party | Third party |

| Risk and liability responsibilities | Homeowner/Business owner, including responsibility for securing insurance | Third party | Third party |

| Who owns the system if the property with the system is sold? | Homeowner/Business owner, including any outstanding loan responsibility | Contract-dependent | Contract-dependent |

| Contract lengths for the transfer of RECs available through Illinois Shines | 15- or 20-year | 15- or 20-year | 15- or 20-year |