This resource is designed to help you understand your Disclosure Form. The Disclosure Form shown here is a sample and may not exactly match your Disclosure Form. See the glossary for helpful terms and definitions.

For information on net metering, once you click the red dot next to “Net Metering” on the sample Disclosure Form below, you will need to select your electric utility in the box that appears to the right. You may then be prompted to select from additional options.

Legal Name / Marketing Name

Approved Vendor and Designee companies may do business under a marketing name that is not their legal business name. Both names are included on the Disclosure Form to clarify the names of the entities the customer is working with.

If the Project Seller has selected an installer at the time that they generate your Disclosure Form, the Disclosure Form will include the Project Installer’s contact information.

If the Project Seller has not yet selected an installer, they will list 3 different companies that might perform the installation work.

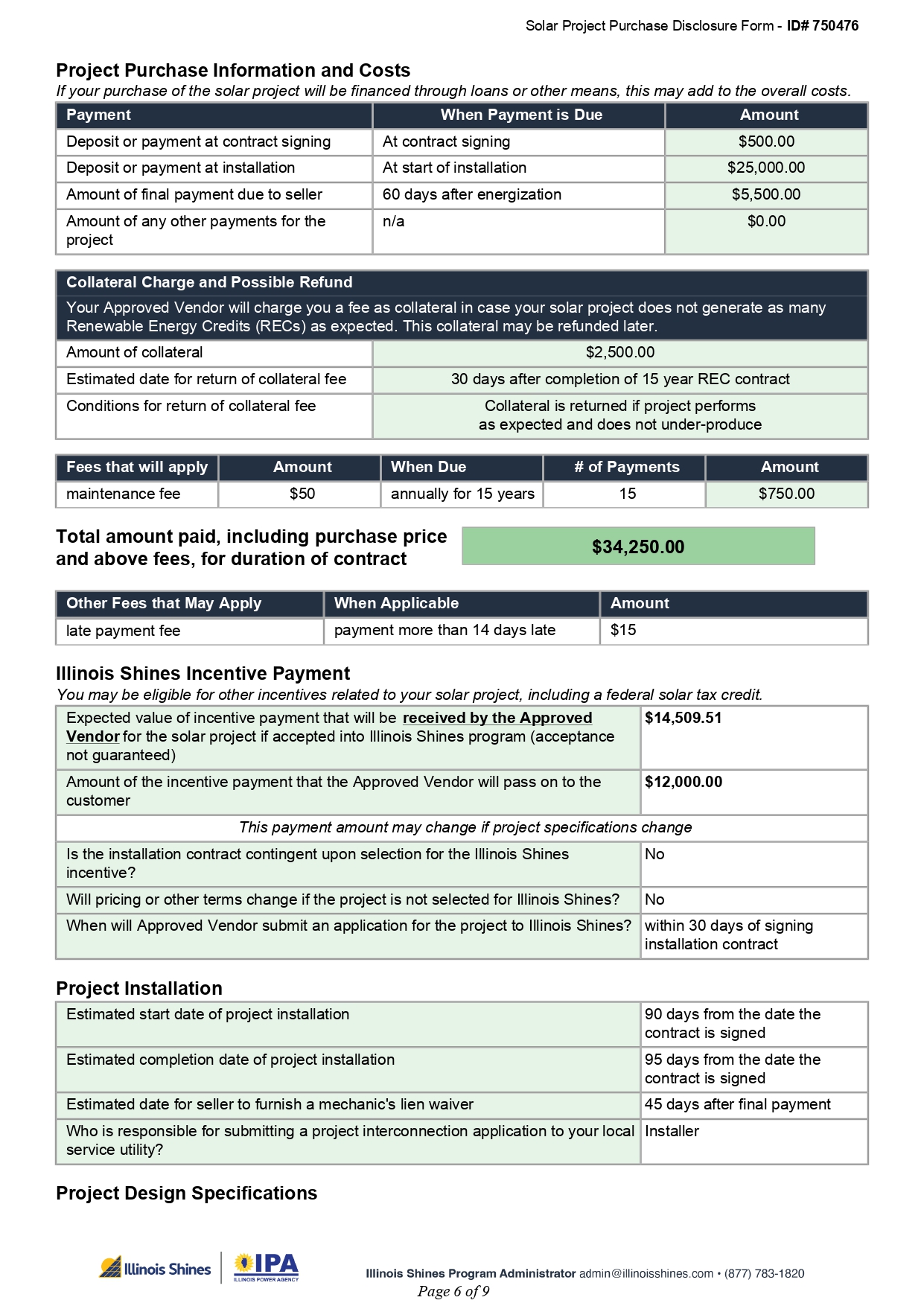

This section is very important, as it lays out the costs that you will pay for your solar project. This includes any payments to purchase the solar project and any fees that will necessarily apply, such as maintenance fees.

These costs and fees are listed out separately and then totaled up.

Please note that if you take out a loan or line of credit to finance the purchase, this will likely increase the overall costs because you will be paying interest to the bank or financing company that provided you with the loan or the line of credit.

For solar project purchases, some Approved Vendors and Designees may require a deposit be paid at contract signing and/or at the start of installation. The company may use this money to secure permits, equipment, and anything else needed before installation occurs. The Approved Vendor or Designee may require the remaining balance be paid once the project is installed.

Your Disclosure Form may include information about a collateral charge. Your Approved Vendor is required to provide a collateral payment to the utility as part of the contract to sell Renewable Energy Credits (RECs). If a solar project does not generate as many Renewable Energy Credits as expected, the utility may withdraw a portion of funds from the collateral payment provided.

Your Approved Vendor may ask you to provide the collateral payment, which is 5% of the overall incentive payment for the RECs from the project. You may be required to pay this as a fee, or, if the Approved Vendor is passing through some of the incentive payment to you, they may withhold part of the payment to cover collateral. Make sure you understand whether, and under what conditions, you will receive any collateral payment back that you might provide at the end of the REC contract (generally 15 years).

Your Approved Vendor will sell the Renewable Energy Credits (“RECs”) generated by your solar project to a utility in exchange for an Illinois Shines incentive payment. The amount of the incentive payment is disclosed here. The Approved Vendor may pass through a portion of that incentive payment to you in a lump sum, or the Approved Vendor may use the incentive payment to reduce the price you pay for your solar project.

Illinois Shines does not have requirements about whether the Approved Vendor has to directly pass through any of the Illinois Shines incentive payment to the customer. An Approved Vendor may structure its solar project offers such that it will pass through some or all of the incentive payment to you, the customer. Different Approved Vendors may pass through different amounts of the Illinois Shines incentive to the customer. If you have questions or concerns about the amount of the REC incentive that will be passed on to you as shown in your Disclosure Form, please discuss with your sales company. You may also want to reach out to other Approved Vendors and Designees to compare quotes.

Your Disclosure Form includes information on when your Approved Vendor plans to submit an application for your solar project to participate in the Illinois Shines program. For more information on the major steps in the application process, you may want to review the Guide to Going Solar. https://illinoisshidev.wpengine.com/wp-content/uploads/2023/05/2023_Guide-to-Going-Solar_ILS_05_31.pdf

The Project Lookup Tool is another helpful resource that allows a customer to view the status of their project application. If your application is at a different stage than expected, please contact your Approved Vendor. https://illinoisshidev.wpengine.com/project-status/

Although there is an estimated installation timeline listed on the Disclosure Form, timeframes for installation can vary based on interconnection and permitting approval, as well as any delays or shortages of solar equipment in the marketplace.

A mechanic’s lien is a legal guarantee for your Approved Vendor or Designee to receive your payment for the solar project installation. The lien typically may be placed if payment is not made for a project or on a loan for a project. A mechanic’s lien waiver is a document from the company who holds your mechanic's lien that states they have been paid in full and waive lien rights to your property. To understand in what circumstances a lien could be placed on your home, please discuss with your sales representative.

Interconnection approval is required from your utility in order to connect to the utility electric grid and energize a solar project. Your Disclosure Form lists the entity responsible for submitting the interconnection application. Once the construction of your solar project is completed, the utility will issue a certificate of completion (COC) or permission to operate (PTO), which your Approved Vendor will submit to the Program in your Part II application.

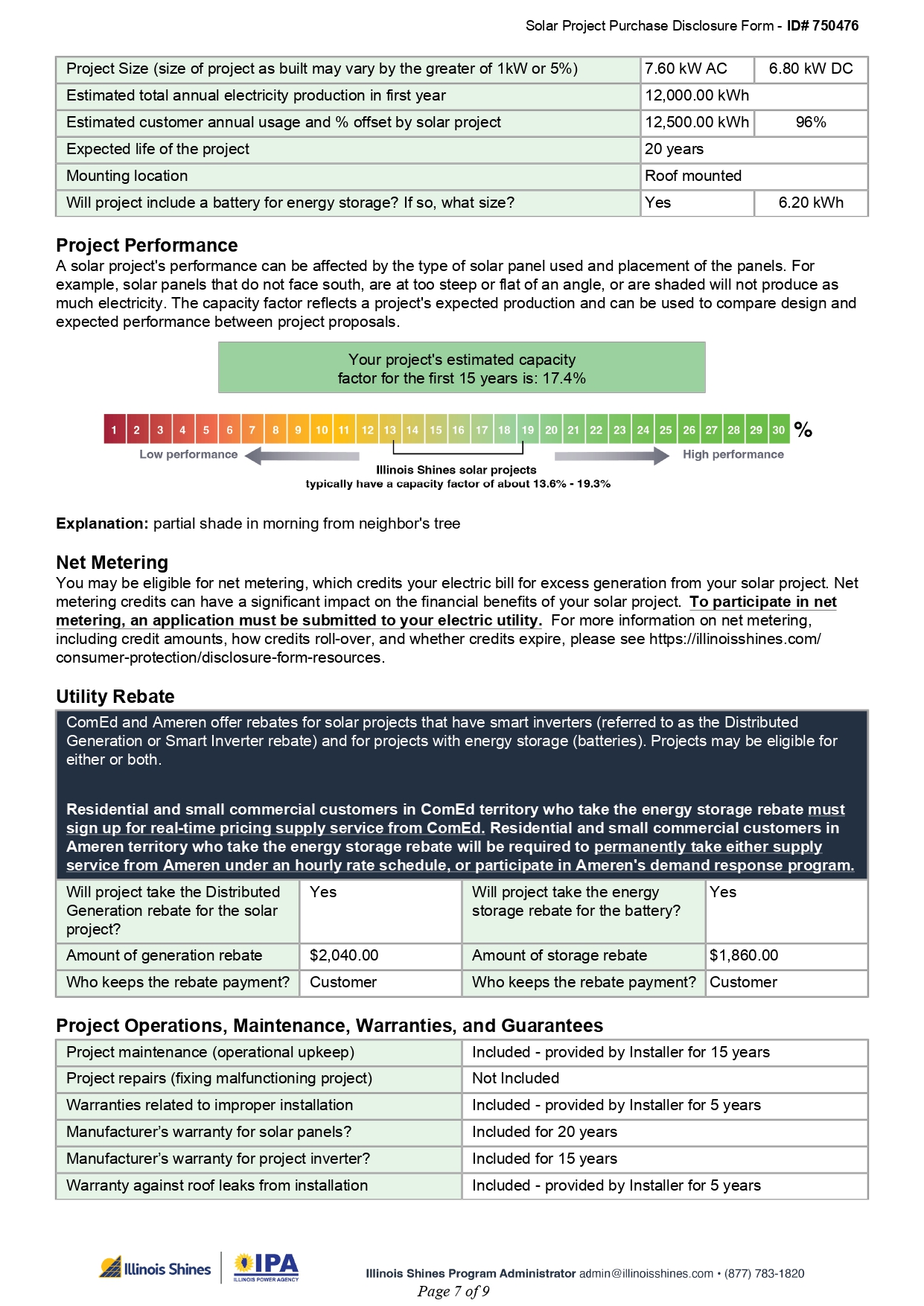

The DC size is the size of all the solar panels combined and is measured by wattage. The AC size is the size of a single inverter or the combined wattage of microinverters. The inverter takes the DC electricity from the solar panels, converts it to AC for use, and sends it to your house and grid. The AC size is usually smaller than DC size because the solar project is not usually generating at full output.

The estimated customer electricity usage is based on your expected usage going forward. If it differs from your historical usage, your solar company will explain the difference at the end of the Disclosure Form in the “Additional Information” section. For example, if you plan to purchase an electric vehicle or install a heat pump, your expected electricity usage may increase. You can compare your expected electricity usage to the estimated generation from the solar project to determine if it is sized correctly for you. You can also check your utility bills to confirm historical usage.

The percentage listed for “% offset by solar project” compares the overall annual generation from your solar project to your overall expected annual usage. This is different from the percentage of electricity that is used directly onsite, which is used for calculating the value of the electricity. For example, the annual electricity generation from the solar project could match your annual usage with an offset percentage of 100%, but at times you will likely be drawing electricity from the grid (for example, at night) and at times you will be sending electricity to the grid (when your solar project produces more power than you are using at that exact time).

The Disclosure Form lists the expected life of the project. Solar panel modules degrade over time and the life expectancy depends on the rate of degradation. The rate of degradation refers to the speed at which solar panels decline in producing electricity over time. Please contact the sales company or equipment manufacturer for information on life expectancy.

When considering a roof mounted solar installation, the age of your roof and when it will need to be replaced are important factors. If a roof needs to be replaced, solar modules will need to be removed, stored, and reinstalled. This is an added cost during the lifespan of your solar project. When considering a ground mounted solar installation, understanding your ground conditions is an important factor and can help decisions on the design. The ground conditions depend on geographical location, soil type, groundwater levels, corrosion potential, and topography. A soil study may be advisable prior to design and installation. Ground mounts may also be subject to local building code requirements.

Some solar projects include a battery. Adding a battery increases the capital costs, but can maximize the amount of electricity generated from the solar project that is used directly onsite (rather than sent back to the grid). Using more electricity directly onsite generally creates more economic value than sending electricity back to the grid. Solar projects with batteries can also be set up to allow you to use your system during a grid outage. Solar projects without batteries cannot be used for back-up power during a grid outage.

This section helps you understand how well the solar project will perform and whether it is sited properly for maximum performance. The range for “typical” Illinois Shines solar projects is calculated by using the “bell curve.” The range for “typical” projects shown on your Disclosure Form reflects the middle 68% of projects (one standard deviation above and below the median). In other words, a “typical” project falls in between the 16th and the 84th percentile.

If the project has lower performance, make sure you understand why this is and whether you will still see the benefits you are expecting from your solar project. It may be that your property or building is not well-suited for solar. Note that projects in northern Illinois generally have a lower performance than projects in southern Illinois because the sun’s rays are less direct the further north a project is.

The capacity factor represents the amount of electricity that your solar project will generate as compared to how much electricity the project would generate if the sun was shining every day of the year, there was no shading, and the solar project was generating the maximum amount of power possible around the clock.

The capacity factor percentage is calculated by dividing your project’s estimated total annual electricity production by the product of the solar project size (nameplate capacity) multiplied by 24 hours a day and 365 days a year. (Capacity Factor = Annual Electricity Production (in kWh) / (Project Size in kW x 24 x 365))

The capacity factor presented on your Disclosure Form is the average capacity factor over the first 15 years of the solar project’s life and assumes that each year, the solar project produces 0.5% less electricity than the previous year.

My Electric Utility is:

ComEd

My project will be approved for net metering on or after January 1, 2025

If your solar project makes more electricity than you use, the excess electricity flows to the grid. Net metering credits you for this excess electricity that your solar project sends to the utility electric grid. On the other hand, if you use more electricity than your project is generating at any point in time, you will pull electricity from the grid.

ComEd will “net out” the extra electricity supply that your project sends to the grid against the electricity that you pull from the grid. For example, if your solar project sends 400 kWh of extra electricity to the grid, and you use 500 kWh of electricity from the grid, your net usage would be 100 kWh. Supply and transmission charges are then calculated based on that net usage. If you send more power to the grid than you pull from the grid, you will receive a credit on your bill for that electricity. Unless you are on hourly pricing (where your electricity rate changes each hour), you can choose whether you want to be credited in kWh (which will then reduce the kWh for which you are charged supply charges in future months), or with monetary credits applied to your bill (calculated based on your electric supply rate). If you have extra credits in a billing period, those credits will rollover to the next month, and will not expire.

For hourly or real-time pricing customers, the net amount of electricity sent to or pulled from the grid will be calculated for each hourly period and a monetary charge or credit calculated for each hour. Then the charges and credits will be totaled for the billing period, and a final charge or credit will be applied.

Your electric delivery charges are not included in net metering. This means that you will be charged delivery charges for the entire amount of electricity that you pull from the grid, regardless of how much electricity you send back to the grid. You will also have non-volumetric (not based on kWh used) customer charges and fees on your bill.

Your solar project will also be eligible for a one-time Distributed Generation (DG) rebate from ComEd. At the beginning of 2025, solar projects for residential and small commercial customers will receive $300/kW for installed solar project capacity and $300/kWh for nameplate capacity for associated energy storage (commonly referred to as "batteries"). For large commercial and industrial customers, the rebate will start at $250/kW for generation and $250/kWh for energy storage.

If you're a residential or small commercial customer and take the storage rebate, be aware that you and any successor customers at that location must sign up for real-time pricing supply service from ComEd. Larger commercial and industrial customers who take the storage rebate will be required to participate in one or more programs offered through ComEd’s Multi-Year Integrated Grid Plan.

The value of the rebate may change when future rebate values are established through a proceeding before the Illinois Commerce Commission. Make sure you understand who keeps the rebate – you or someone else (for example, the solar company).

If you receive energy supply from an Alternative Retail Electric Supplier (ARES) but your electricity is delivered by ComEd, either ComEd or the ARES will be responsible for net metering calculations and billing. If you switch to a new electricity supplier, make sure to ask the new supplier if any accumulated net metering credits will be carried over and applied by the new supplier.

My project is expected to be approved for net metering by December 31, 2024, and my Disclosure Form has a section titled, “Net Metering and DG [or Smart Inverter] Rebate”

The below information applies to customers whose net metering applications are submitted PRIOR to January 1, 2025. Net metering policies and rates change after January 1, 2025.

Net metering credits you for electricity that your solar project sends to the utility electric grid. If your solar project makes more electricity than you are use, the electricity flows to the grid. On the other hand, if you use more electricity than your project is generating at any point in time, you will pull electricity from the grid.

ComEd will “net out” the extra electricity that your project sends to the grid against the electricity that you pull from the grid. For example, if your solar project sends 400 kWh of extra electricity to the grid, and you use 500 kWh of electricity from the grid, your net usage would be 100 kWh.

For customers who receive “full retail rate” net metering, ComEd will then only charge you supply, delivery, and other volumetric fees (fees that are based on kWh usage) on the net usage. If you receive net metering just on your energy supply, ComEd would charge you supply and transmission fees only on the netted amount of usage, but would charge you delivery fees and other volumetric fees (fees that are based on kWh usage) on the total (or gross) amount of electricity that you draw from the electric grid.

If you are in ComEd or Ameren’s service territory, the solar project can apply for a rebate from the utility. Solar projects for residential and small commercial customers receive $300/kW for installed solar project capacity and $300/kWh for nameplate capacity for associated energy storage (commonly referred to as "batteries"). If the solar project takes the rebate for generation (regardless of whether you also take the energy storage rebate), you will only receive net metering for your electricity supply and transmission fees (rather than full retail rate net metering). If you take the generation rebate, your net meter credits will no longer expire annually.

Make sure you understand who keeps the rebate – you or someone else.

If a residential or small commercial project only takes the generation rebate (and not the storage rebate), there are no specific requirements for what type of energy supply the customer signs up for. If a residential or small commercial project takes the storage rebate, that residence must sign up for real-time pricing supply service from ComEd.

For commercial and industrial customers, the rebate is $250/kW for generation and $250/kWh for energy storage. Taking the rebate does not affect commercial and industrial customers’ net metering rate, which is generally already lower than full retail rate. Commercial and industrial customers who take the storage rebate will be required to participate in a peak load reduction program, which ComEd is still developing.

My project is expected to be approved for net metering by December 31, 2024, and my Disclosure Form has a section titled “Net Metering”

The below information applies to customers whose net metering applications are submitted PRIOR to January 1, 2025. Net metering policies and rates change after January 1, 2025.

If you are a residential or small business customer in ComEd service territory, and are not taking the Distributed Generation Rebate, you will receive full retail rate net metering (also called 1:1 net metering). Net metering credits you for electricity that your solar project sends to the utility electric grid. If your solar project makes more electricity than you are use, the electricity flows to the grid. On the other hand, if you use more electricity than your project is generating at any specific time, you will pull electricity from the grid.

ComEd will “net out” the extra electricity that your project sends to the grid against the electricity that you pull from the grid. ComEd will then only charge you supply, delivery, and other volumetric fees (fees that are based on kWh usage) on the netted amount of usage.

For example, if your solar project sends 400 kWh of extra electricity to the grid, and you use 500 kWh of electricity from the grid, ComEd will only charge you for using 100 kWh of electricity. (For electricity from your solar project that you directly use onsite, there are no utility charges or credits.)

Thinking about it another way, you will receive credits on your electricity bill for electricity that you send back to the grid which are valued at the same per kWh rate that you pay for electricity (that is, the full retail rate).

If you overall send more electricity to the grid in a month than you pull from the grid, ComEd will not charge you any volumetric fees (fees that are based on kWh usage), and the extra net metering credits (in kWh) will “roll over” to the next month. You will still have other charges on your ComEd bill, such as the customer charge.

For residential and small business customers in ComEd territory that have not taken the DG Rebate, net metering credits expire annually. Customers can choose whether this happens in April or October. Generally, solar customers choose to re-set credits in April because it allows them to build up credits over the summer (when solar generates a lot of electricity) and then use up those built-up credits over the winter (when solar generates less electricity).

If you receive energy supply from an Alternative Retail Electric Supplier (ARES) but your electricity is delivered by ComEd, ComEd will provide net metering of the delivery charges and other volumetric charges (charges based on kWh usage) from ComEd. The ARES will be responsible for net meter crediting for supply and transmission charges. If you switch to a new electricity supplier, make sure to ask the new supplier if any accumulated net metering credits will be carried over and applied by the new supplier. ComEd will also continue to apply your accumulated net metering credits to your delivery charges and other volumetric charges (charges based on kWh usage) from ComEd.

Large commercial and industrial customers generally receive fewer net metering credits, such as credits equal to the electricity provider’s avoided supply cost, rather than the full retail rate (which includes both delivery and supply service charges).

Ameren

My project will be approved for net metering on or after January 1, 2025

If your solar project makes more electricity than you use, the excess electricity flows to the grid. Net metering credits you for this excess electricity that your solar project sends to the utility electric grid. On the other hand, if you use more electricity than your project is generating at any point in time, you will pull electricity from the grid.

Ameren will “net out” the extra electricity supply that your project sends to the grid against the electricity that you pull from the grid. For example, if your solar project sends 400 kWh of extra electricity to the grid, and you use 500 kWh of electricity from the grid, your net usage would be 100 kWh. Supply and transmission charges are then calculated based on that net usage. If you send more power to the grid than you pull from the grid, you will receive a credit on your bill for that electricity. Unless you are on hourly pricing (where your electricity rate changes each hour), you can choose whether you want to be credited in kWh (which will then reduce the kWh for which you are charged supply charges in future months), or with monetary credits applied to your bill (calculated based on your electric supply rate). If you have extra credits in a billing period, those credits will rollover to the next month, and will not expire.

For hourly or real-time pricing customers, the net amount of electricity sent to or pulled from the grid will be calculated for each hourly period and a monetary charge or credit calculated for each hour. Then the charges and credits will be totaled for the billing period, and a final charge or credit will be applied. Again, any extra credits will be rolled over to the next month and will not expire.

Your electric delivery charges are not included in net metering. This means that you will pay delivery charges and taxes/other charges for the entire amount of electricity that you pull from the grid, regardless of how much electricity you send back to the grid. You will also have non-volumetric (not based on kWh used) customer charges and fees on your bill.

Your solar project will also be eligible for a one-time Smart Inverter rebate from Ameren. At the beginning of 2025, solar projects for residential and small commercial customers will receive $300/kW for installed solar project capacity and $300/kWh for nameplate capacity for associated energy storage (commonly referred to as "batteries"). For large non-residential customers, the rebate will start at $250/kW for generation and $250/kWh for energy storage.

If you take a rebate for the storage device, be aware that you and the successor customers at your location will be required to permanently take either supply service from Ameren under an hourly rate schedule, or participate in Ameren's demand response program. There may be additional optional programs offered in the future for customers receiving a rebate for a storage device.

The value of the rebate may change when future rebate values are established through a proceeding before the Illinois Commerce Commission. Make sure you understand who keeps the rebate – you or someone else (for example, the solar company).

If you receive energy supply from an Alternative Retail Electric Supplier (ARES) but your electricity is delivered by Ameren, your ARES will determine whether they or Ameren will be responsible for net metering calculations and billing. If you switch to a new electricity supplier, make sure to ask the new supplier if any accumulated net metering credits will be carried over and applied by the new supplier.

My project is expected to be approved for net metering by December 31, 2024, and my Disclosure Form has a section titled, “Net Metering and DG [or Smart Inverter] Rebate”

The below information applies to customers whose net metering applications are submitted and whose projects have permission to operate (PTO) granted PRIOR to January 1, 2025. Net metering policies and rates change after January 1, 2025.

Net metering credits you for electricity that your solar project sends to the utility electric grid. If your solar project makes more electricity than you are use, the excess electricity flows to the grid. On the other hand, if you use more electricity than your project is generating at any point in time, you will pull electricity from the grid.

Ameren will “net out” the extra (excess) electricity that your project sends to the grid against the electricity that you pull from the grid. For example, if your solar project sends 400 kWh of extra electricity to the grid, and you use 500 kWh of electricity from the grid, your net usage would be 100 kWh.

When you receive the rebate, your net metering will be just on your energy supply and transmission charges. Ameren would charge you supply and transmission fees only on the netted amount of usage, but would charge you delivery fees and other volumetric fees (fees that are based on the kWh usage) on the total (or gross) amount of electricity that you draw from the electric grid.

If you are in Ameren’s service territory, you are eligible for a smart inverter rebate on your solar project and/or energy storage device.

The solar project can apply for a rebate from the utility. Solar projects for residential and small commercial customers receive $300/kW for installed solar project capacity and $300/kWh for nameplate capacity for associated energy storage (commonly referred to as "batteries"). If the solar project takes the rebate for generation (regardless of whether you also take the energy storage rebate), you will only receive net metering for your electricity supply and transmission fees (rather than full retail rate net metering). If you take the generation rebate, your net meter credits will no longer expire annually.

Make sure you understand who keeps the rebate – you or someone else.

If you're a residential or small non-residential customer, and you take a rebate for the storage device, be aware that you and the successor customers at your location will be required to permanently take either supply service under an hourly rate schedule, or participate in Ameren's demand response program.

For large commercial and industrial customers, the rebate is $250/kW for generation and $250/kWh for energy storage. Taking the rebate does not affect commercial and industrial customers’ net metering rate, which is generally already lower than full retail rate. If you take the rebate for the storage device, you will also be required to participate in one or more programs offered through Ameren's Multi-Year Integrated Grid Plan.

My project is expected to be approved for net metering by December 31, 2024, and my Disclosure Form has a section titled “Net Metering”

The below information applies to customers whose net metering applications are submitted and whose projects have permission to operate (PTO) granted PRIOR to January 1, 2025. Net metering policies and rates change after January 1, 2025.

If you are a residential or small business customer in Ameren service territory, and are not taking the Distributed Generation Rebate, you will receive full retail rate net metering (also called 1:1 net metering). Net metering credits you for electricity that your solar project sends to the utility electric grid. If your solar project makes more electricity than you are use, the electricity flows to the grid. On the other hand, if you use more electricity than your project is generating at any specific time, you will pull electricity from the grid.

Ameren will “net out” the extra electricity that your project sends to the grid against the electricity that you pull from the grid. Ameren will then only charge you supply, delivery, and other volumetric fees (fees that are based on kWh usage) on the netted amount of usage.

For example, if your solar project sends 400 kWh of extra electricity to the grid, and you use 500 kWh of electricity from the grid, Ameren will only charge you for using 100 kWh of electricity. (For electricity from your solar project that you directly use onsite, there are no utility charges or credits.)

Thinking about it another way, you will receive credits on your electricity bill for electricity that you send back to the grid which are valued at the same per kWh rate that you pay for electricity (that is, the full retail rate).

If you overall send more electricity to the grid in a month than you pull from the grid, Ameren will not charge you any volumetric fees (fees that are based on kWh usage), and the extra net metering credits (in kWh) will “roll over” to the next month. You will still have other charges on your Ameren bill, such as the customer charge.

For residential and small business customers in Ameren territory that have not taken the DG Rebate, net metering credits expire annually. Customers can choose whether this happens in April or October. Generally, solar customers choose to re-set credits in April because it allows them to build up credits over the summer (when solar generates a lot of electricity) and then use up those built-up credits over the winter (when solar generates less electricity).

If you receive energy supply from an Alternative Retail Electric Supplier (ARES) but your electricity is delivered by Ameren, Ameren will provide net metering of the delivery charges and other volumetric charges (charges based on kWh usage) from Ameren. The ARES will be responsible for net meter crediting for supply and transmission charges. If you switch to a new electricity supplier, make sure to ask the new supplier if any accumulated net metering credits will be carried over and applied by the new supplier. Ameren will continue to apply your accumulated net metering credits (in kWh) to your delivery charges. Starting in November 2023, Ameren will calculate net metering credits regardless of supplier, so you will no longer lose credits if you switch suppliers.

Large commercial and industrial customers generally receive fewer net metering credits, such as credits equal to the electricity provider’s avoided supply cost, rather than the full retail rate (which includes both delivery and supply service charges) because the delivery charges are demand (kW) based instead of usage (kWh) based.

MidAmerican

My project will be approved for net metering on or after January 1, 2025

If your solar project makes more electricity than you use, the excess electricity flows to the grid. Net metering credits you for this excess electricity that your solar project sends to the utility electric grid. On the other hand, if you use more electricity than your project is generating at any point in time, you will pull electricity from the grid.

MidAmerican will “net out” the extra electricity supply that your project sends to the grid against the electricity that you pull from the grid. For example, if your solar project sends 400 kWh of extra electricity to the grid, and you use 500 kWh of electricity from the grid, your net usage would be 100 kWh. Supply and transmission charges are then calculated based on that net usage. If you send more power to the grid than you pull from the grid, you will receive a credit on your bill for that electricity. Unless you are on hourly pricing (where your electricity rate changes each hour), you can choose whether you want to be credited in kWh (which will then reduce the kWh for which you are charged supply charges in future months), or with monetary credits applied to your bill (calculated based on your electric supply rate). If you have extra credits in a billing period, those credits will rollover to the next month, and will not expire until you terminate service.

For hourly or real-time pricing customers, the net amount of electricity sent to or pulled from the grid will be calculated for each hourly period and a monetary charge or credit calculated for each hour. Then the charges and credits will be totaled for the billing period, and a final charge or credit will be applied.

Your electric delivery charges are not included in net metering. This means that you will pay delivery charges for the entire amount of electricity that you pull from the grid, regardless of how much electricity you send back to the grid. You will also have non-volumetric (not based on kWh used) customer charges and fees on your bill.

If you receive energy supply from an Alternative Retail Electric Supplier (ARES) but your electricity is delivered by MidAmerican, the ARES will be responsible for net metering calculations and billing. If you switch to a new electricity supplier, make sure to ask the new supplier if any accumulated net metering credits will be carried over and applied by the new supplier.

My project is expected to be approved for net metering by December 31, 2024

The below information applies to customers whose net metering applications are submitted PRIOR to January 1, 2025. Net metering policies and rates change after January 1, 2025.

If you are a residential or small business customer in MidAmerican service territory, you will receive full retail rate net metering (also called 1:1 net metering). Net metering credits you for electricity that your solar project sends to the utility electric grid. If your solar project makes more electricity than you are use, the electricity flows to the grid. On the other hand, if you use more electricity than your project is generating at any specific time, you will pull electricity from the grid.

MidAmerican will “net out” the extra electricity that your project sends to the grid against the electricity that you pull from the grid. MidAmerican will then only charge you supply, delivery, and other volumetric fees (fees that are based on kWh usage) on the netted amount of usage.

For example, if your solar project sends 400 kWh of extra electricity to the grid, and you use 500 kWh of electricity from the grid, MidAmerican will only charge you for using 100 kWh of electricity. (For electricity from your solar project that you directly use onsite, there are no utility charges or credits.)

Thinking about it another way, you will receive credits on your electricity bill for electricity that you send back to the grid which are valued at the same per kWh rate that you pay for electricity (that is, the full retail rate).

If you overall send more electricity to the grid in a month than you pull from the grid, MidAmerican will not charge you any volumetric fees (fees that are based on kWh usage), and the extra net metering credits (in kWh) will “roll over” to the next month. You will still have other charges on your MidAmerican bill, such as the customer charge.

For residential and small business customers in MidAmerican territory, net metering credits expire annually. Customers can choose whether this happens in April or October. Generally, solar customers choose to re-set credits in April because it allows them to build up credits over the summer (when solar generates a lot of electricity) and then use up those built-up credits over the winter (when solar generates less electricity).

If you receive energy supply from an Alternative Retail Electric Supplier (ARES) but your electricity is delivered by MidAmerican, MidAmerican will provide net metering of the delivery charges and other volumetric charges (charges based on kWh usage) from MidAmerican. The ARES will be responsible for net meter crediting for supply and transmission charges. If you switch to a new electricity supplier, make sure to ask the new supplier if any accumulated net metering credits will be carried over and applied by the new supplier. MidAmerican will continue to apply your accumulated net metering credits to your delivery charges and other volumetric charges (charges based on kWh usage) from MidAmerican.

Large commercial and industrial customers generally receive fewer net metering credits, such as credits equal to the electricity provider’s avoided supply cost, rather than the full retail rate (which includes both delivery and supply service charges).

Municipal Utility or Rural Electric Coop or Mt Carmel

Net metering credits you for electricity that your solar project sends to the utility electric grid. If your solar project makes more electricity than you are using at that time, the electricity flows to the grid. Mount Carmel and each municipal utility and rural electric cooperative have their own rules for how they calculate the value of net metering credits.

Your Disclosure Form will contain information in this section that explains how your utility or electric co-operative will credit you for electricity that your project sends back to the grid.

The entity that submits your solar project’s interconnection application to the utility usually also submits your net metering application. You may want to ask your Approved Vendor or Designee who will submit a net metering application for your solar project.

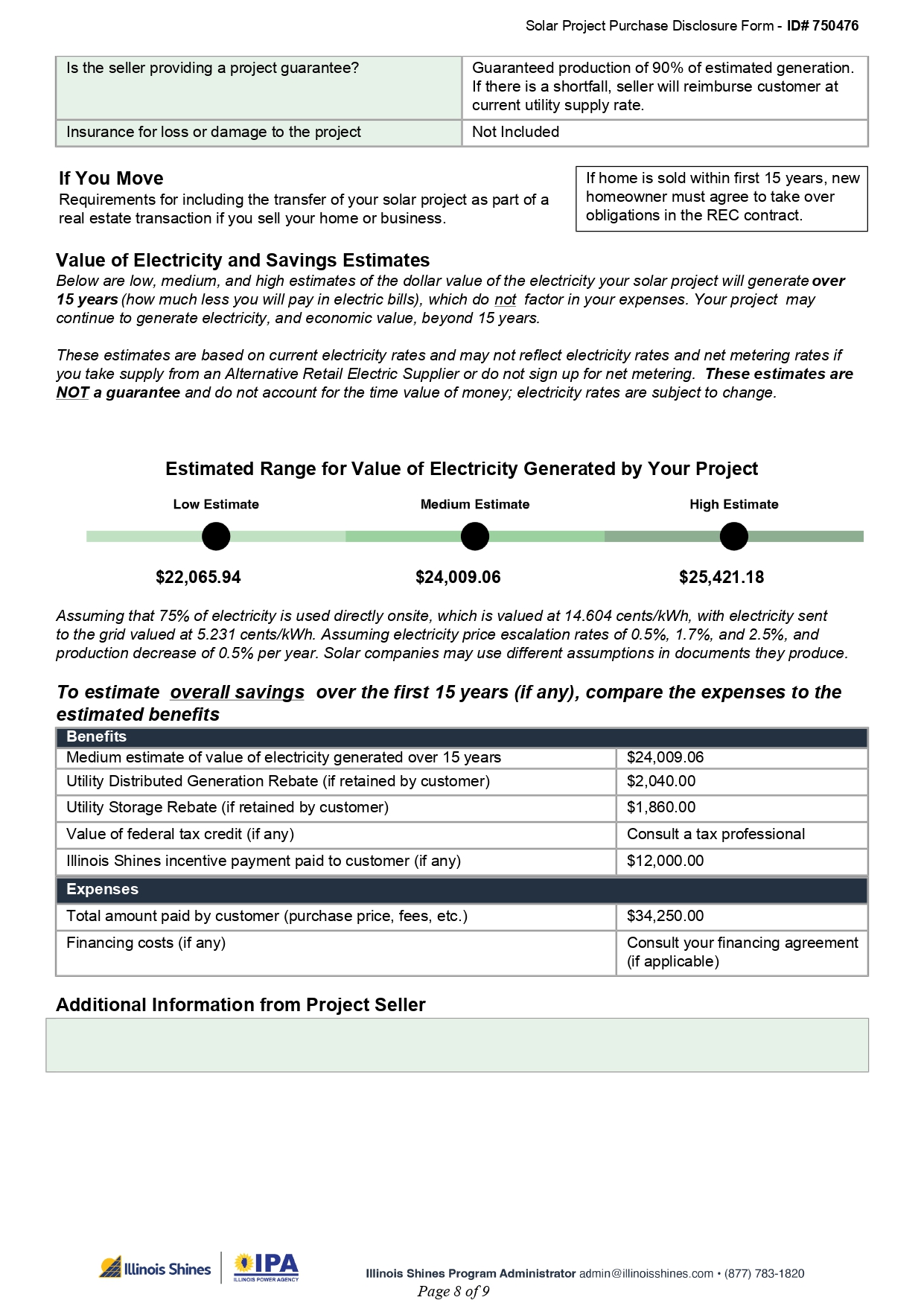

The “Utility Rebate” section is included on Disclosure Forms for customers in ComEd and Ameren service territories. Both ComEd and Ameren offer utility rebates for having a distributed generation system (such as a solar project) and a separate utility rebate for having energy storage (such as a battery) that is associated with a distributed generation project. If their systems qualify, residential customers are eligible for a distributed generation rebate of $300/kW based on the solar project’s DC size, and a battery rebate of $300/kWh based on the battery size. These rebates are separate from the Illinois Shines program. Make sure you understand your utility’s terms and conditions for taking the rebate, and make sure you understand who will keep the rebate (you or someone else).

This section estimates the value of the electricity that the solar project will generate. Due to the variance in utility rates across Mt. Carmel, municipal utilities, and rural coops, this section is only included on Disclosure Forms for residential and small commercial customers in the utility territories of ComEd, Ameren, and MidAmerican.

This section of the Disclosure Form estimates the total economic value of the electricity that the solar project will generate. The value is calculated by multiplying the amount of electricity generated by the solar project (in kWh) by the applicable electricity rate (in cents/kWh). The Disclosure Form uses an estimate of how much electricity from the solar project will be used directly onsite (rather than sent back to the grid). Electricity that is used onsite is multiplied by the current utility retail rate, because this electricity replaces electricity that would otherwise be purchased from the utility at the retail rate. Electricity that is sent back to the grid is multiplied by the current utility supply rate, because ComEd, Ameren, and MidAmerican provide bill credits for electricity sent back to the grid at their current supply rate. If a customer intends to sign up for utility hourly pricing or dynamic / “time of use” pricing (where the price for electricity changes throughout the day), the Disclosure Form will estimate the average applicable retail and supply rates (based on current standard retail and supply rates for that utility). For customers who take supply from an Alternative Retail Electric Supplier (“ARES”), the Disclosure Form estimates will be based on the utility’s standard retail and supply rates—be aware that actual value may be different based on the ARES rates.

To estimate the value over the full 15 years, the calculation assumes that the value of electricity will increase by 0.5%, 1.7%, or 2.5% per year, and that the amount of electricity that the solar project generates will decrease by 0.5% per year. These estimates do not account for the time value of money. This means that value generated several years in the future is not discounted.

Dive into a different form

Go back to Disclosure Form Main Page

Glossary

Alternative Retail Electric Supplier (ARES)

Companies other than the default electric utility that sell electric supply. Customers may choose to purchase electricity supply from an ARES rather than the default utility. The utility will still deliver the electricity and generally will still bill for both supply and delivery.

Approved Vendor (AV)

Solar contractor or developer that enrolls your solar project in the Illinois Shines program, and also sells the Renewable Energy Credits (“RECs”) generated from solar projects to the utility in exchange for an Illinois Shines incentive payment.

Capacity Factor (CF)

The ratio of actual energy generated by a power plant over a time period (usually a year) and the total energy that power plant could have generated over the same time period, if it was optimally sited and ran at full capacity 24 hours a day, 365 days a year. The capacity factor for solar projects may seem relatively low, because solar projects only generate electricity when the sun is shining.

Designee

Entities that have direct interaction with end use customers on behalf of an Approved Vendor. Designees may work as installers, marketing firms, lead generators, and/or sales organizations on behalf of an Approved Vendor. Designees must be registered with the Program.

Distributed Generation (DG)

A system that generates electricity and is located on-site, behind a customer’s meter, and used primarily to offset a single customer’s load; it cannot exceed 2,000 kW AC in size. Distributed generation (also called on-site generation or decentralized generation) is a term describing the generation of electricity for use on-site, rather than transmitting energy over the electric grid from a large, centralized facility (such as a coal-fired power plant).

Distributed Generation Rebate

Under the Illinois Public Utilities Act (220 ILCS 5/16-107.6), ComEd and Ameren must both offer a rebate to customers who install distributed generation projects, including solar, that meet certain eligibility requirements, including being equipped with a smart inverter. ComEd refers to this as the Distributed Generation Rebate. More information from ComEd is available here. More information from Ameren is available here.

Energy Storage Rebate

Under the Illinois Public Utilities Act (220 ILCS 5/16-107.6), ComEd and Ameren must both offer a rebate to customers who have distributed generation projects, including solar, that incorporate an energy storage system, like a battery. These systems must meet certain eligibility requirements. The utility rebate for energy storage can be taken in addition to the utility rebate for the underlying distributed generation system. More information from ComEd is available here. More information from Ameren is available here.

Federal Tax Credit

The federal government has a tax credit program for solar projects. Owners of residential solar projects may be eligible to deduct up to 30% of the cost of their solar project from their federal income taxes. The Department of Energy’s Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics is available at https://www.energy.gov/. Note that some homeowners may not pay enough in federal income tax to be able to use the full value of the tax credit, but tax credits can be rolled over to use in a subsequent year. Consult a tax professional to discuss your circumstances.

Illinois Power Agency

State Agency that administers the procurement of renewable energy resources to meet Illinois’ renewable energy goals, including renewable energy incentive programs like Illinois Shines.

Illinois Shines

A state program administered by the Illinois Power Agency that supports the development of new photovoltaic distributed generation systems and new photovoltaic community renewable generation projects in Illinois through the purchase of Renewable Energy Credits (“RECs”). Illinois Shines is also commonly referred to by its legislative name, the “Adjustable Block Program.”

Illinois Solar for All (ILSFA)

A state program administered by the Illinois Power Agency that supports the development of new photovoltaic distributed generation and new community renewable generation projects that serve low- and middle-income households, and non-profits and public facilities that serve and are located in environmental justice communities or income-eligible communities.

Interconnection

The process of connecting a solar project to the electric grid, which requires approval from the utility that operates the electric grid. All Illinois Shines projects must be interconnected to the electric grid.

Kilowatt (kW)

1,000 watts of electrical power.

Kilowatt-hour (kWh)

1,000 watts of power used for one hour. Electrical energy consumption and production is measured in kWh. For example, if a 100-watt lightbulb is used for 10 hours, it will use 100 watts of electricity per hour, or 1000 watts over 10 hours. Over the 10-hour period, the lightbulb used 1 kWh.

Mechanic’s lien waiver

A document, often provided to a customer upon completion of payment, that indicates that a contractor is waiving its right to file a mechanic’s lien. A mechanic’s lien is used by contractors to ensure that they are paid; the lien gives the contractor a security interest in the customer’s property.

Net Metering

Metering and billing arrangement to compensate distributed energy generation (DG) system owners for generation that is exported to the utility grid.

Program Administrator

The entity responsible for running day to day operations of Illinois Shine, which is currently Energy Solutions.

Project Installer

The company that will complete the installation work for the solar project.

Project Seller

The company that enters into the installation / sales contract with the customer.

Renewable Energy Credits (RECs)

The environmental attributes of 1 MWh of electricity generated by a renewable generator, such as a solar project. Note that 1 MWh = 1000 kW.

Smart Inverter Rebate

Under the Illinois Public Utilities Act (220 ILCS 5/16-107.6), ComEd and Ameren must both offer a rebate to customers who install distributed generation projects, including solar, that meet certain eligibility requirements, including being equipped with a smart inverter. Ameren sometimes refers to this as the Smart Inverter Rebate. More information from Ameren is available here.