Other Opportunities

Community Power Accelerator

The U.S. Department of Energy created the Community Power Accelerator to connect community-serving distributed solar projects and developers (including community-based organizations) with philanthropists, lenders, and investors in an online ecosystem to drive more local, affordable energy. The Accelerator offers four key free services including a platform to connect developers and capital providers, free training courses, technical assistance, and a credit-ready checklist.

Every distributed solar project on the Community Power Accelerator is designed to achieve one or more of the following: Solar access and consumer choice; affordability and household savings; reliability, resilience, and security; local economic development; or solar workforce and entrepreneurship.

How do you join?

The process is simple!

- Sign up at communitypower.energy.gov

- Create your organization’s profile

- Connect with other developers and capital providers!

If you have any questions or would like to connect with a member of the Community Power Accelerator’s team, please contact [email protected].

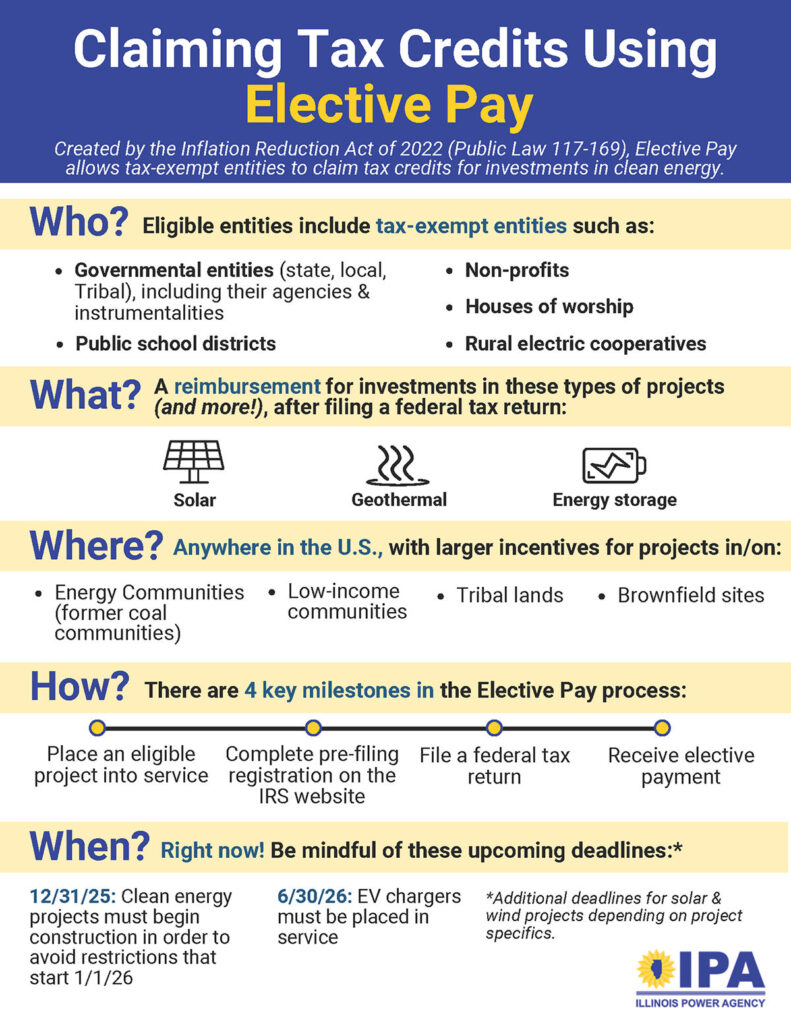

Elective Pay

House Resolution 1 (“H.R.1”), signed into law on July 4, 2025, introduces significant changes to clean energy tax credits made available under the Inflation Reduction Act, including those that can be claimed via Elective Pay (Find out more information on H.R.1 here). The Illinois Power Agency (IPA) is interested in ensuring that entities across Illinois leverage federal tax credits for their solar and other clean energy projects, including by using Elective Pay to reimburse a portion (often at least 30%) of project costs. To further that goal, the IPA will be conducting outreach and providing education and technical assistance on this new opportunity for tax-exempt entities, including webinars for Elective Pay-eligible entities and Approved Vendors to provide detailed information on qualification, compliance, and filing. If you are an eligible entity or Approved Vendor (AV) interested in IPA’s resources on Elective Pay, please contact the IPA. Additional information is available at the IPA website’s Elective Pay page.

- December 3 Webinar for Tax-Exempt Entities

On December 3, 2025, IPA held a webinar on Elective Pay and municipalities, public school districts, nonprofits, and other tax-exempt organizations that have placed a clean energy project in service in the approximately the last year, or will soon do so, were encouraged to attend. The recording and presentation slides may be accessed here. - December 17 Webinar for AVs Working with Tax-Exempt Entities

IPA will host a second webinar on Elective Pay on Wednesday, December 17, 2025, at 3:00 p.m. CPT designed for AVs working with municipalities, public school districts, nonprofits, and other tax-exempt organizations that have placed a clean energy project in service in the last year or so, or will soon do so. Please register with this link.

It is still possible for Elective Pay-eligible entities to claim these tax credits for projects recently placed into service, and for projects still in the planning or construction phases.

- Deadline to file a tax return and claim the tax credit (or request a 6-month extension): 4.5 months following the end of an entity’s tax year in which they placed an eligible project into service

- December 31, 2025: entities must ensure their projects have met “beginning of construction” milestones in order to avoid more onerous sourcing requirements that begin 1/1/26

- July 4, 2026: solar projects beginning construction on 7/5/26 or later must be placed in service by 12/31/2027

Visit ipa.illinois.gov for more information.